As we move further into the new year, wheat prices have slid a little further.

The latest AHDB Grain Market Report shows May-24 UK feed wheat futures closing on Thursday 18th at £185.25/t, down over £5.00/t from the same period of the previous week. The contract is currently at its lowest price to date. The Nov-24 contract also saw similar falls, closing at £199.75/t.

The pressure is due to the expectation of high global maize supplies this season. Last Friday, the USDA increased its estimate of the 2023 US maize crop and global maize end of season stocks.

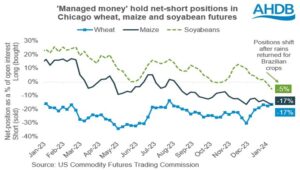

Speculative traders still hold large net-short positions in Chicago wheat and maize futures, which can be seen as predicting a bearish outlook for wheat and maize prices. While the latest official data is for positions held on 9 January, anecdotal information suggests that investment funds have been net-sellers since then (LSEG).

This reflects that, despite uncertainty over the Brazilian maize crop size, currently the global grain supply and demand forecasts show a surplus for 2023/24. Plus, the forecasts for US maize end of season stocks have increased. As a result, the net-short, the speculative traders hold in Chicago maize on 9 January was larger than in mid-November.

May-24 Paris rapeseed futures gained €2.25/t to close at €429.50/t, shrugging off pressure from Chicago soyabean futures. May-24 rapeseed futures seem to be supported by technical moves on the Feb-24 contact, which finishes trading on 31 January and still had over 26,000 open contracts. Meanwhile, the Nov-24 contract gained fell slightly to close at €432.25/t.

In a change from the autumn, speculative traders also now hold a small net-short in Chicago soyabean futures too. In late-2023 they held a net-long position reflecting worries over dry weather in Brazil, and growing concern over the potential crop size.

Rains returned to the key growing areas before Christmas, though there’s still a wide range in forecasts for the Brazilian soyabean crop. Both the USDA and Conab cut their forecasts last week. Based on these current forecasts, the global outlook still points potentially surplus supplies in 2023/24, tying in with the shift in positions held by speculative traders.

If prices rise while speculative traders still hold sizeable net-shorts, they are likely to need to re-position. In turn, such re-positing could add to the speed of a price rally. However, the market is likely to need to see disruption to supplies for sustained price rises, such as further sharp cuts to the Brazilian maize and soyabean crop forecasts.