The dreadful problems that Ukraine is suffering has resulted in a massive up swing in the price of oilseed rape in the UK. Not only the breadbasket of Europe, Ukraine is responsible for 80% of sunflower oil consumed in the UK, with Russia making up a significant proportion of the remainder. Already supermarkets such as Waitrose are rationing cooking oil as world shortage bites.

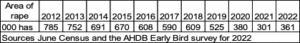

Neil Groom, technical director of Grainseed, thinks that we will see a revival in the oilseed rape area in the next few years, based on the crops’ increasing profitability as well as its importance as a break crop in the arable rotation. “The area of winter oilseed rape was knocked back by Cabbage Stem Flea beetle pressure together with the ban of neonicotinoid insecticide seed dressing. In 2012 the area of rape was over 750,000 hectares and now, according to the AHDB Early bird survey is has plummeted to 361,000 hectares in 2022 – about half of its peak.”

“Cabbage Stem Flea beetle levels have built up areas where rape has been grown in a tight rotation. Yields have been hit hard by this pest and in some instances crops completely wiped out. No chemical alternative to neonics has been found but research into cultural methods of control abound. To reduce this pest pressure, growers can always extend their rotations and block crop their fields. This will also help reduce diseases such as Phoma and clubroot. Drilling the crop into a good seedbed with moisture and choosing a variety with innate vigour, you stand a reasonable chance of out-growing pest damage. One of our conventional rape varieties, Keeper, bred specifically for the UK market by Mike Pickford, shows excellent early vigour at planting. Keeper has very large seeds giving it extra seedling vigour which aids establishment,” he says.

Mr Groom adds that growers should not over-simplify vigour as this is a characteristic of the individual variety, not the variety type. “In other words, not all hybrids are vigorous whilst some conventionals are very vigorous. Vigour is something that varies tremendously from variety to variety and some conventional rape varieties being much more vigorous than hybrid varieties. It is a message that we have been sending out to the marketplace for a few years now. We advise looking at the individual variety itself, not just whether it is a conventional or a hybrid.”

Work by ADAS has shown that drilling early or late will reduce pest pressure. Drilling early September during pest migration appeared to be the worst scenario. But Mr Groom advises growers to always wait for good drilling conditions.

He also points out that the price for oilseed rape is looking very attractive and is close to unprecedented £900/t. “This makes rape a more profitable crop, out-performing most other break crops, despite huge increases in some inputs such as fertilisers. Growers can now use more cost-effective post-emergence herbicides rather than relying on the more expensive pre-emergence ones and this also ensures no inputs are made until a successful crop has established. This should encourage more growers back into growing rape. You can also grow rape using the normal equipment you have on the farm, with no need for special investment in machinery. The demand for oil crops globally is likely to be tight in the short to medium term, supporting high prices.”

“Finally, oilseed rape remains an excellent break crop in any arable rotation, especially when following winter barley. It can be used to break the cycle of weed resistance in blackgrass, ryegrass and wild-oats as you can use different chemistry with different mode of action in rape than you do in wheat or barley, reducing the resistance pressure. It also provides the best entry for wheat, giving a boost in yield. It has a large tap root which helps improves soil structure.

Mr Groom concludes that with the current high price, profitability its characteristics as an excellent break crop plus opting for a naturally vigorous variety with good disease resistance and standing power, many growers could be tempted back to growing rape this autumn.