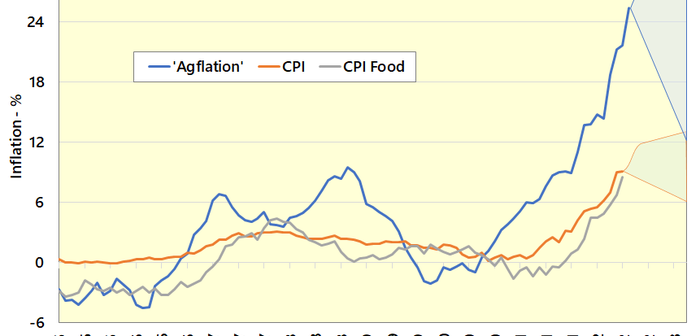

Andersons’ latest estimates for June show that Agflation now stands at 25.3%. Since the onset of the Russia-Ukraine conflict in February, input costs have soared and are at levels which have not been seen in decades.

Andersons’ Agflation index builds upon on Defra price indices for agricultural inputs and weights each input cost (e.g., animal feed) by the overall spend by UK farmers. Andersons then provides a more up-to-date estimate of the price index for each input cost category. As the ‘official’ Defra figures are updated, Andersons Agflation estimates are also adjusted to take account of the Defra updates.

Three times higher

In comparison with general inflation, as measured by the consumer prices index (CPI) and food prices (CPI Food) which stand at 9.1% and 8.5% respectively, Agflation is nearly three times higher. Given the current situation with the Russia-Ukraine conflict and the upheaval caused across numerous commodity supply-chains, particularly feed, fuel, and fertiliser, Agflation is set to remain at elevated levels for at least the remainder of this year.

Andersons’ Agflation index builds upon on Defra price indices for agricultural inputs and weights each input cost (e.g., animal feed) by the overall spend by UK farmers. Andersons then provides a more up-to-date estimate of the price index for each input cost category.

Due to the surging input costs, many farm businesses are feeling a severe squeeze on margins. Thus far, some sectors have been better able to withstand the inflationary storm than others.

Arable sector less affected

The arable sector is less affected for 2022 as most farmers have bought forward their fertiliser and output prices have hit record levels (although this contributes to feed cost rises for livestock). For many farmers in this position, 2022 is shaping up to be a stellar year – the value of the unharvested wheat crop has risen by more than 50% since it went in the ground. That said, challenges loom for 2023. High input costs and taxation on 2022 profits will stretch working capital requirements.

As alluded to above, the livestock sectors are under additional pressure due to the burden of increased feed costs, which account for nearly a quarter of the weighting for the Agflation Index. Whilst pig prices have risen, they remain insufficient to cover the soaring production costs that pig farmers have had to contend with in recent months.

Dairy and livestock farms have also been feeling the strain. The dairy sector has seen some significant price rises in recent months, partly because UK milk production volumes are down, and processors and retailers are trying to encourage farmers to boost their production to meet with consumer demand. This will help the dairy sector to mitigate some of the inflationary strain.

These severe inflationary pressures are occurring at a time when all farms in England are facing cuts in BPS payments, which will reach 35% during 2023.

In such times, it is crucial to demonstrate competent cost management, particularly in terms of working capital, which will be essential to steer farm businesses through the current crisis.

* represents the % change versus the same month a year earlier.